Naval: Wealth is the thing you want. Wealth is assets that earn while you sleep; it’s the factory of robots cranking out things. Wealth is the computer program running at night that’s serving other customers. Wealth is money in the bank that is reinvested into other assets and businesses.

A house can be a form of wealth, because you can rent it out; although that’s a less productive use of land than running a commercial enterprise.

My definition of wealth is oriented toward businesses and assets that can earn while you sleep.

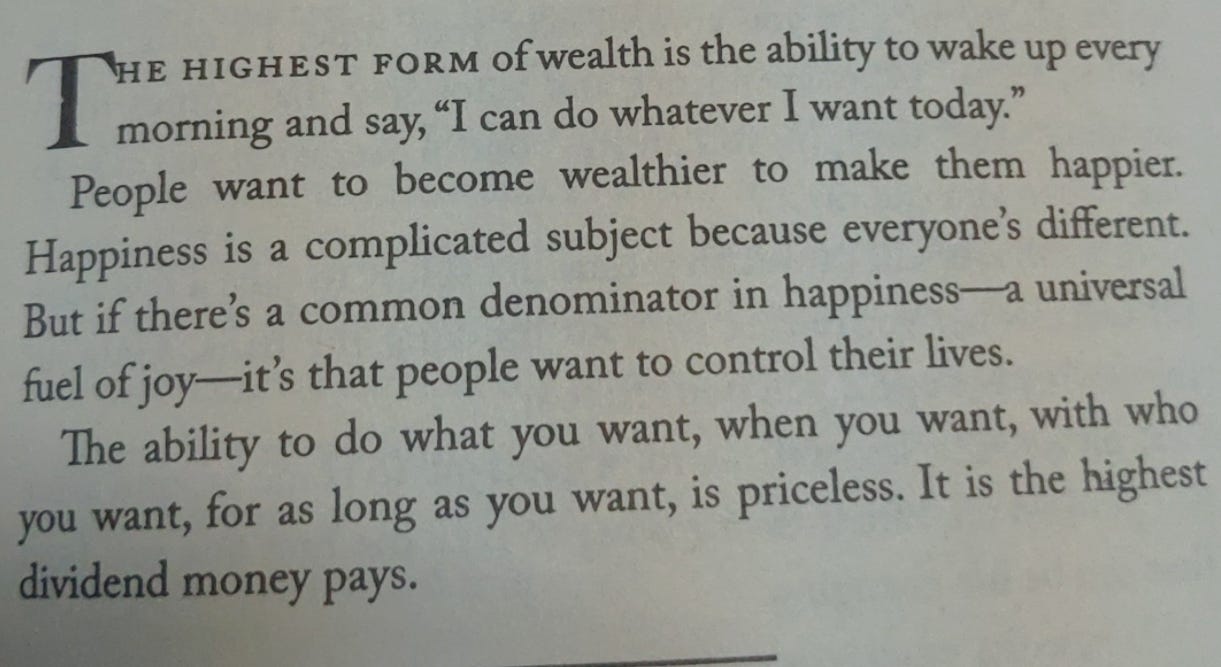

Wealth buys your freedom

You want wealth because it buys you freedom—so you don’t have to wear a tie like a collar around your neck; so you don’t have to wake up at 7:00 a.m. to rush to work and sit in commute traffic; so you don’t have to waste your life grinding productive hours away into a soulless job that doesn’t fulfill you.

The purpose of wealth is freedom; it’s nothing more than that. It’s not to buy fur coats, or to drive Ferraris, or to sail yachts, or to jet around the world in a Gulf Stream. That stuff gets really boring and stupid, really fast. It’s about being your own sovereign individual.

[Screenshot below from Pyscology of Money]

You’re not going to get that unless you really want it. The entire world wants it, and the entire world is working hard at it.

The above is just an entire transcript of what Naval says about wealth. I have to quote it, so that you really understand, what I am going to discuss. I think you get this, wealth is not money. Wealth is assets that earn you while you are sleeping.

I am just going to list down top assets that can generate wealth that are very easy to invest:

Nifty 100 and S&P 500. - These are both indexes, Nifty100 is India's top100 companies, which are worth 76% of the total(2000+ companies) public listed companies in India. And S&P500 is a US index that represents the top 500 companies. You can invest in these top companies just by opening an account in a mutual fund app - Paytm money, Groww, etc. And then just buy SIP(monthly investment) of any amount you want to. So, you are just buying top companies like Reliance, TCS, and all. And you all know reliance is growing, TCS is growing. So, winners grow. Read more here, if you are still not satisfied - https://vikashkhandelwal.substack.com/p/easiest-investment-outperform-everyone

Gold - I am not in much favor of Investing in Gold these days. But, it’s still an asset that generated great returns. So, if you are still investing. Invest in sovereign gold bonds. Why? Sovereign Gold Bonds prices increase with the price of gold, plus you will get 2.5% interest per year on the amount invested. You can invest in it when RBI issues it. You need to have a Demat account. You can open a Demat account in upstox - https://upstox.com/open-account/?f=RZTH . And they will email you when RBI is issuing you a bond, and then you can apply.

Bitcoin and Ethereum - You may have heard of it. So, these are digital assets and technologies. So, Bitcoin is like digital gold. It’s an asset, that people like to hold. As more people believe in Gold, and they buy it. Its prices increases. Similarly, the more the number of people buying Bitcoin, the more is its price. Ethereum is a technology and coin too, above which many coins are made, and tech is developed. There are many such coins. But, I believe in top things, because that’s what most people are into. And the more the people are into it, the more they will spread it. But, it’s not just holding them, because that clearly defies, what we read. We have to put it to work. So, read it, so you will understand how to buy Bitcoin and Ethereum and how to put it to work - https://vikashkhandelwal.substack.com/p/earn-more-than-just-holding-crypto

Ultra short debt funds - For short terms goals, we can keep money here. It will give returns as a fixed deposit. You can take out money anytime. You can use the same mutual fund apps to invest in it. Just search “ultra-short debt funds“ and you will find a good one by PGIM or HDFC. Don’t look for a higher return.

I would say you should have some cash holding too so that it supports you for a year with no work, that’s called an emergency fund. Plus extra cash for enjoyment and short-term goals. Don’t forget health insurance, it’s the most basic thing, a hospital can eat all your savings.

And then you are good to allocate money into an asset. Preferably I will choose nifty 100 and sp500 as the highest allocation around 60%, then a little into gold - 10%, and in Bitcoin and Ethereum around 10% and the rest 20 % in ultra-short debt funds.

Be a HODLER, A person who never sells. Let money compound.

Asset allocation is necessary so that you are safe with maximum investment, and the latter you are taking just a little risk for great returns.

If you are just reading and doing nothing, you are just wasting time. Please abort.

Follow me on https://twitter.com/AmVikashHere